— Lalit Jalan, CEO & Whole-time Director,

Reliance Infrastructure Ltd

— Lalit Jalan, CEO & Whole-time Director,

Reliance Infrastructure Ltd

Part of the

Anil Dhirubhai Ambani Group, Reliance Infrastructure

Ltd is India's leading utility company with a turnover of over

15,000 crore. It has a formidable presence across major highgrowth

sectors like highways, power, metro rail, airports and

speciality real estate. In the power sector, RInfra spans all

aspects—generation, transmission, distribution, EPC contracting

and trading. RInfra needs special mention for its deep involvement

in PPP-based infrastructure projects.

Lalit Jalan, who oversees all

the business verticals of RInfra, speaks at length about its power

transmission business. An interview by

Venugopal Pillai.

Reliance Infrastructure became India's first developer of a power

transmission line awarded on tariff-based competitive bidding

when it clinched WRSSS-II. Tell us more on this project and its

current status.

WRSSS-II (Western Region System Strengthening Scheme) was

split into four packages of which two packages (A & D) are being

developed by Power Grid Corporation of India, while Packages B

and C were offered on tariff-based competitive bidding, which were

awarded to RInfra. This is the country's first ever 100 per cent

privately owned transmission project that executes inter-state

lines, which are elements of the National Grid.

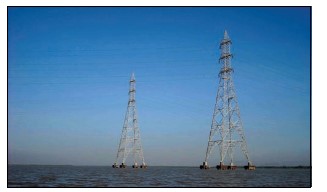

WRSSS-II projects, being developed by RInfra on BOO basis,

consist of nine 400kV transmission lines, spanning 1,500 km across

Maharashtra, Gujarat and Madhya Pradesh. RInfra has already

commissioned three lines, which have started earning revenues.

Another two lines are expected to be commissioned shortly, which

would add to the revenues. The remaining four lines are scheduled

for commissioning in FY2012.

How are the two ultra mega power transmission projects awarded

to Reliance Infrastructure (North Karanpura and Talcher-II)

progressing? Could you elaborate on RInfra invoking the "force

majeure" clause on the two projects?

The special purpose vehicles (SPV) created for these projects

have already been transferred to RInfra in April/May 2010 and

financial closure was also achieved in September/October

2010. However, enabling clearance to start project construction

under Section 164 of Electricity Act 2003 is yet to be received

from the Government of India. As a result of this delay, which is

beyond our control, we have sent out notices invoking "force

majeure" clause to the beneficiaries and subsequently

approached the CERC for redressal, which is currently under

consideration of the Hon'ble Commission

India has plans to award a series of mega power transmission

projects using the tariff-based competitive bidding route on the

Case-2 model. What challenges do you see in this endeavour?

The Case-2 model is specific to power generation projects and not

to the transmission projects, which will be awarded on a tariffbased

competitive bidding. Government of India has notified five

transmission projects recently and two of these are already in

qualification stage. The key challenge will be to reduce the cycle

time from NIT to handover of SPV to the successful bidder, which is

currently taking a little bit longer.

How do you gauge India's success rate so far and how do you see

the PPP model unfold in the power transmission sector in the years

to come?

Till date eight projects in the Central Sector and six projects in

state sector by Rajasthan, UP and Haryana have been awarded

under tariff-based competitive bidding. Experimentation that

started with the WRSSS-II projects has been successful with

commissioning of first three lines by RInfra. From now on all

inter-state transmission projects but for a few exclusions shall be

awarded on tariff-based competitive bidding, open for private

participation. The state sector may follow suit in some time, meanwhile more states can be expected on the lines of Rajasthan,

Haryana and UP to opt for PPP model.

Thanks to the "Open Access" policy, progressive states are now

allowing consumers to import power from other states. Do you see

this, coupled with upcoming IPP plants, spurring the demand for

inter-state transmission lines?

Thanks to the "Open Access" policy, progressive states are now

allowing consumers to import power from other states. Do you see

this, coupled with upcoming IPP plants, spurring the demand for

inter-state transmission lines?

This has already been the driving force for the planning at Central

and State sector. At current levels of ten percent of the power

generated in the country being traded, lots of such transactions

have been held up due to network congestion. This clearly indicates

increased need for faster augmentation of inter-state and intrastate

transmission network across the country.

Power transmission projects are by nature very land-centric and

can be bogged down by right of way and forest clearance issues.

How can India reduce procedural delay and hasten the

development of bulk power transmission corridors?

Transmission lines traverse through long distances and have to

cross agricultural lands, forests and industrial zones. While

implementing transmission lines, managing right of way is most

critical to complete to project in time. Many times issues like

handling law & order situation, obtaining clearances from multiple

governmental agencies pose as challenges. In the present

structure, private developer is compelled to handle all these risks

that beyond its direct control. For facilitation quick implementation

of transmission projects, it is essential to have a government

agency to facilitate managing right of way as is done by NHAI in

roads sector

Reliance Infrastructure had formed a joint venture with PGCIL for

setting up evacuation infrastructure for the Koldam and Parbati

projects. What is your view on PGCIL's philosophy in forming

minority JVs with private developers for power transmission

infrastructure?

Our JV, named Parbati Koldam Transmission Company Ltd, has

already achieved financial closure and obtained other critical

clearances. Construction contracts have been awarded and

construction has commenced. These JVs were formed under the

earlier guidelines where tariff fixation was possible through costplus

route. Under the current policy framework, any such JV

formed by PGCIL shall have to participate in tariff-based

competitive bidding for the projects put up for the same.

What is your general take on India's attempts to build UHVAC

1,200kV power transmission infrastructure?

A 1,200kV UHVAC transmission line is expected to carry about

6,000 to 8,000 mw of power. This is about 10 times that of a 400kV

line, which is the current backbone of Indian inter-state

transmission network. This technology has been under

development and testing.

States like Maharashtra, Gujarat and Haryana are building interstate

power transmission infrastructure through private

participation. What is RInfra's plan of bidding for intra-state lines?

RInfra has incorporated Reliance Power Transmission Ltd as a

subsidiary focused on such business opportunities. Based on the

size and other factors, we have been participating and are open to

participate in all models.

Very briefly, how would you rate India's overall success in terms of

private participation in power transmission? What has been India's

biggest achievement at the policy level?

Very briefly, how would you rate India's overall success in terms of

private participation in power transmission? What has been India's

biggest achievement at the policy level?

The government of India has taken a long time since enactment of Electricity Act 2003 in evolving the enabling policy, regulatory and

contractual framework for private participation in transmission

business. In the Central sector, private participation has been

successfully experimented whereas the state sector is trying to

catch up. Major policy shift in central sector has been to move from

a monopolistic model of transmission development to a total

competitive model. Similar move in state sector is expected.

Can you suggest three policy recommendations to boost private

sector participation in India's power transmission sector?

I would say:

- Statutory and regulatory clearances essential to start project

construction should be made available prior to handing over of

the project to private developer

- Facilitation of obtaining RoW and Forest clearance by

Government

- Commodity Risk during construction period above a certain

threshold be made pass through

Please summarize RInfra's growth plans in the power transmission

sector for the next 5-7 years.

Future investment opportunity in transmission sector is currently

estimated to be in excess of

200,000 crore. RInfra's growth plan

is emanating from this investment opportunity. Presently RInfra

has five transmission projects with an outlay of about

7,000 crore

which the company is executing in full swing. In view of the ample

opportunities available, the company would continue to participate

in profitable opportunities in the sector.