India is striving to augment power generation capacity and matching T&D infrastructure. However, power demand is far outstripping supply. Added to this is the stark reality that power quality in most parts of India is inadequate. Whatever be the progress on improving power supply – both in terms of quantity and quality, there is increasing reliance on power backup and conditioning equipment. This segment is poised to grow, reflecting not just India’s demand for power but for power continuity, says

Venugopal Pillai.

The power backup industry is a steadily growing sector. It represents a gamut of devices that keep power supply running in the absence of grid power. The growth of the power backup industry reflects the need for quality power for equipment associated with critical services. Phenomenal growth in the IT and financial sectors have spawned a digital revolution. Much of India’s soft services today run on a digital backbone comprising electronic equipment that needs to be kept running 24x7. India has reached a stage where downtime of critical equipment is not only a matter of inconvenience but a direct economic loss.

India's power generation capacity has undoubtedly been rising. During the decade ending 2012, for instance, the country’s installed power capacity rose by nearly 80 per cent. However, demand outstripped supply and even today there is an energy shortage of 8-10 per cent on average. The quantitative aspect apart, there are also concerns on the quality of power supply. Grid power is very often tainted with irregularities ranging from momentary voltage fluctuations to a prolonged blackout.

To cope with both quantitative and qualitative aberrations in grid power supply is an economic segment called the power backup and conditioning industry. This industry has matured over the years and does much more than just offering “standby” power. As it also improves the quality of power supply by correcting technical glitches, “power backup” equipment is now referred as “power backup and conditioning” equipment or sometimes “power continuity” equipment.

Power continuity or conditioning equipment mainly comprises UPS (uninterruptible power supply) systems and inverters. The traditional genset does not fall under the PCE segment but more in the “alternate power” category. Power continuity equipment usually ensures quality power supply to downstream equipment in the absence of grid power. PCE is in force till grid power is restored or till an alternate power system like a diesel generator steps in.

Untitled Document

Types of UPS systems |

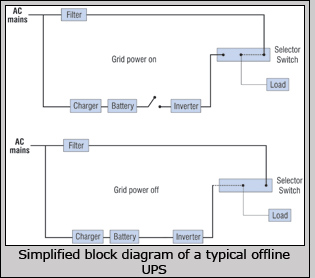

The basic components of a UPS system include the battery charger, battery and inverter. The inverter “inverts” direct current (DC) from the battery to alternating current (AC) that can be fed to the appliance that the UPS system is meant to serve. The battery charger (sometimes known as the converter) “converts” AC from the grid source into DC that can be stored in the battery. There are three broad categories of UPS systems – offline UPS, online interactive UPS and true online UPS. The basic components of a UPS system include the battery charger, battery and inverter. The inverter “inverts” direct current (DC) from the battery to alternating current (AC) that can be fed to the appliance that the UPS system is meant to serve. The battery charger (sometimes known as the converter) “converts” AC from the grid source into DC that can be stored in the battery. There are three broad categories of UPS systems – offline UPS, online interactive UPS and true online UPS.

Offline UPS: This is the simplest form of a UPS and is used for low-rating applications, typically a home computer. In an offline UPS, grid power forms the primary source of power, after it is filtered for noise. When grid power is fed into the offline UPS, some of it is also used to charge the battery. When grid power fails, the battery comes alive through a selector switch and current from the battery, after passing through an inverter, is fed to the appliance. As an offline UPS is of low-rating, usually 1 KVA or less. It can only offer power backup (standby power) for a limited period of time. In its typical usage—that of a home computer—the standby power is usually enough to shut down the machine cleanly. (See diagram)

Line interactive UPS: A line interactive UPS is a more refined version of the offline UPS where the battery charger, inverter and source selection switch are replaced by a single converter/inverter device. The converter/inverter device charges the battery and also inverts DC to AC to feed the appliance. AC line (grid) power is the primary source and when it fails, the battery comes into play. As the source is always connected to the inverter, a line interactive UPS offers better protection against switching transients as compared with an line UPS. A line interactive UPS is used for relatively higher ratings (750 VA to 5 KVA) and finds applications in small computer networks.

Online UPS: This is also known as true online UPS or double-conversion UPS. In this system, the AC grid power is converted to DC and fed to a DC bus. The DC bus is connected to an inverter that converts DC into AC for consumption by the power equipment. This DC bus also takes power from the battery. The battery is charged by a battery charger that is fed through the AC mains. The main source for power therefore is the DC bus, which either has “converted” grid power or, in its absence, battery power. True online UPS offers better filtering of noise and all anomalies associated with AC power, despite the fact that the efficiency due to “double conversion” is lower. Online UPS are used for high rating applications (above 5 KVA) like data centres, etc. |

A UPS is a device that offers backup power for a limited time, say less than an hour. Stored power from the UPS, in times of no grid supply, is used only to shut down the downstream equipment safely (e.g. home computers). It is also used a stop-gap before power from a large alternate source (e.g. diesel generator) is made available. An inverter, on the other hand, usually provides backup power for longer duration, even up to 8 hours. Inverters are mainly used in the summer months, when grid power deficit peaks, and there are planned power cuts. Thanks to modern lifestyles, high-rating inverters that can even support power-centric appliances like air conditioners are now being used. (Experts say that the term “inverter” is a misnomer. Any power backup equipment should always be referred to as a UPS. An inverter per se is a component in a UPS system that converts direct current (DC) to alternating current (AC). There can thus be no UPS without an inverter. However, the term “inverter” is commonly used in India to denote a UPS of higher rating.)

Depending on the battery capacity, the UPS industry is divided in four categories—less than 1 KVA, 1 — 5 KVA, 5 — 30 KVA, and more than 30 KVA. The first category includes the typical UPS connected to a single computer, be it at home or in a small business firm. The largest category in terms of volume of equipment rolled out is that of 1 KVA to 5 KVA. Frost & Sullivan has estimated the size of the Indian UPS industry in FY11 at $528.5 million, forecast to grow to $828.2 million by FY18.

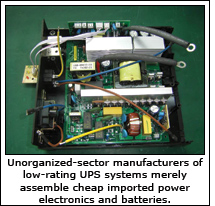

A UPS or an inverter is essentially packaged equipment comprising a battery and power electronics. In most cases, UPS manufacturers source batteries from other suppliers and hence the overall quality of the UPS lies in the power electronics and packaging. For low-rating UPS systems (less than 1 KVA), power electronics are available by way of cheap imports from China and Taiwan. Hence, a small-time UPS manufacturer reduces to a mere assembler of batteries and circuits. This explains why there is a plethora of small-scale players in the low-rating UPS category. India continues to import critical raw material (components) used in electronics circuitry, thanks to a weak local manufacturing base. This is why India does not have a fully-integrated cycle in terms of electronic circuitry, also explaining why domestic production cannot be as cost-competitive as imports.

Microstructure:

Microstructure: The Indian power continuity industry, comprising UPS and inverters, has a typical pyramid microstructure. At the top are established companies—Indian as well as foreign—rolling out quality products and catering to the higher end of the market. This segment includes homegrown brands and also leading multinationals. The Indian power continuity market is also witnessing widespread interest of foreign companies in either a direct takeover or a joint venture. (See Box: Uninterrupted foreign interest). At the bottom of the pyramid is a large collection of small players that cater to the low-rating (less than 1KVA) UPS category.

As discussed earlier, the low-end UPS manufacturing class represents companies that merely assemble batteries and imported power electronics. These manufacturers cater to local markets and as such only have a regional presence. Established players cannot compete on the cost front and hence stay away from the race. However, these low-end UPS manufacturers cannot offer quality after-sales service and are hence facing slow extinction.

Demand drivers: IT and IT-enabled services are the biggest demand drivers for the UPS industry. The biggest deployment of UPS systems is found in the banking & financial services industry (BFSI), telecom and the information technology industry. Even critical sectors like defence and healthcare are significant users of power backup equipment like UPS and inverters. The growing hospitality industry is emerging as a keen consumer of power backup equipment like high-rating inverters.

Untitled Document

Uninterrupted foreign interest

|

|

The Indian UPS industry has seen much interest from international players. While some big foreign names are operating through wholly-owned Indian subsidiaries, there are several others that have chosen the inorganic route to gain entry into the market.

APC (American Power Conversion), a Schneider Group company, Socomec UPS of France, Eaton, Emerson, etc are amongst the oldest international names in the Indian UPS market. What is interesting to note is that multinationals are on the lookout for strong homegrown brands. Such acquisitions help faster penetration as the brand and the dealership network are already entrenched in the market. It is worthwhile mentioning that acquisitions in the electrical equipment industry have been rampant – covering major areas like cables, switchgear, transformers, etc.

Here are some cases of multinationals acquiring controlling stake in Indian UPS companies. In 2001, Tata Power sold its entire 50 per cent stake in the joint venture Tata Liebert Ltd to Emerson Electric. Emerson is the parent company to Liebert. The joint venture then became part of Emerson Network that is amongst the leading UPS players in India today.

In around 2002, DB Power Electronics, based in Pune, was acquired by UK-based Chloride Group. Subsequently, DB Power became part of the Emerson Group following its global takeover of Chloride.

In recent years, Schneider Electric acquired controlling stake of Luminous Power Technologies, a big domestic brand of UPS and inverters. Legrand also took over the UPS business of Chennai-based Numeric Power Systems. Hitachi of Japan, in 2011, acquired controlling stake in Gujarat-based Hi-Rel Power Electronics Pvt Ltd, a leading name in industrial UPS, drives, generators, etc. The company has since been renamed Hitachi Hi-Rel Power Electronics Pvt Ltd, and very recently inaugurated its new manufacturing facility at Sanand in Gujarat.

|

|

In major metropolitan cities where power supplies are fairly stable and of good quality, low-rating UPS are generally used for standalone computers. However, desktop computers are gradually making way for laptops and smart phones, which is substantially bringing down the demand for UPS systems. When it comes to small businesses, the offtake of UPS systems is still low because most micro and small business enterprises have standalone computers that do not readily call for UPS systems. An industry expert suggested that servers—unlike standalone computers—immediately warrant the need for a UPS system, regardless of the power situation. Hence, the uptake for low-rating UPS systems depends on the pace at which small business formalize their computer operations by adopting the client-server module as opposed to the current standalone topography.

Data centres will remain as the biggest demand generators for UPS systems. It is estimated that 40 per cent of the total cost of setting up a data centre goes towards UPS equipment. Apart from data centres associated with the banking and financial services sector, cloud computing is also a big area for which dedicated data centres are being opened up. As an expert pointed out, the work achieved out of a desktop computer in earlier days is now achieved through cloud computing through smart phones. Hence power continuity equipment is moving from home computers to cloud-computing data centres.

In a general sense, the demand for UPS systems will depend on the growth of data-centric services. The more the country gets “e-powered,” the more will be the dependence on data and more so on the uninterruptible access to data.

Apart from IT and ITeS, the traditional demand sectors, newer demand drivers are shaping up, reflecting India’s socio-economic development. One such is the education sector that is getting increasingly IT-enabled. Right from primary schools to professional institutions, teaching techniques nowadays involve modern audiovisual equipment. School students are also expected to operate dedicated computers that are usually connected to a main server. All this calls for power backup and conditioning equipment. Experts strongly feel that education will be a powerful business driver in the years ahead.

Another big demand driver that is slowly emerging is e-governance. The National e-Governance Plan envisages long-term growth and sustenance of e-governance of India. The deployment of IT hardware in government departments is growing rapidly. It is not merely digitization of data but even services will be dispensed through the electronic medium. The fast pace government is procuring IT hardware including central servers augurs favourably for the UPS industry.

Untitled Document

|

Typical Power Problems

|

|

- Failure: Total loss of grid power supply, also known as power outage

- Sag: A short-term drop in voltage of grid power, around 80 to 85 per cent of normal values, lasting from a few milliseconds to a few seconds

- Surge: A short-term rise in voltage, above 110 per cent of normal values, lasting for microseconds. A strong surge is referred to as a spike and can be very damaging to downstream equipment.

- Over-voltage: Increased voltages for an extended period of time

- Under-voltage: A decrease in utility voltage for an extended period of time from few minutes to few days

- Line Noise: Random, sporadic, or unwanted electrical signals of high frequency or electromagnetic interference from other equipment

- Frequency Variation: Deviation from the nominal frequency (50 or 60Hz) that can cause motors to increase or decrease speed

- Switching Transient: Instantaneous under-voltage (also called notch) in the range of nanoseconds

- Harmonic Distortion: An alteration of the pure sine waveform due to nonlinear loads

|

Emerging Technologies

When the Indian IT industry was in its rudimentary stages, which is say a decade ago, so was the UPS industry. Power backup and conditioning equipment was just a standard UPS system attached to a home computer. Over the years, the industry has evolved in keeping with higher standards introduced by foreign companies and even those developed indigenously.

For data centres, which form the core demand driver for UPS systems, newer technologies like modular UPS have evolved. Such a design allows for replacement of UPS in live conditions thereby maintaining power continuity. Rack-mountable UPS is another innovation that is finding acceptance due to the built-in space efficiency aspect.

Technologies that are used in the making of UPS systems are not only getting more efficient but also greener. Modern UPS systems offer the dual advantage of lower carbon footprint and greater energy efficiency.

UPS suppliers are not limiting themselves to only supplying equipment. Instead, they are undertaking complete power management for their clients. These value-added services could include power quality audit, remote monitoring of UPS equipment, etc. Modern UPS systems are also equipped with communication software that enables remote monitoring of the equipment. This is particularly helpful in data centres located at remote branch locations.

Recent years have also seen the commercialization of solar power technology in UPS systems. Although such systems can provide a drastic cut in energy bills, the capital costs are on the higher side. Secondly, the payback period is rather prolonged, going even up to 7 years depending on the size (KVA) of the UPS system. Solar UPS systems are finding applications in large retail outlets in tier-II and tier-III cities where grid power is relatively unstable.

The Way Forward

The Way Forward

The growth of the UPS industry should be around 7-10 per cent per year in the medium term. Data centres associated with the financial sector will be the main demand drivers but other areas like telecom, healthcare and defence will also propel sales. Education and e-governance are sectors to keenly look out for, industry experts feel.

What holds the key to UPS manufacturers is the ability to give customized solutions and value-added services. Consumers of UPS systems are gradually turning discerning, seeking tailor-made solutions. More than power continuity, a UPS system also has a part to play in the larger energy-efficiency and conservation goals of companies. It is in this light that small UPS manufacturers, particularly those operating at the lowest end (<1 KVA), will die out. Mere assembling of power electronics and batteries is no longer a viable business proposition. Customization, dedicated after-sales service and value-added services are the new norms. There are over 400 manufacturers of low-end UPS systems and many of them will be edged out of business if they make no conscious effort to upscale their product and service offerings. Even dealers of cheap UPS systems imported from China and Taiwan are facing bleak prospects in view of growing consumer resistance.

The small and medium business enterprise sector will be a big demand generator in the coming years. Some estimates suggest that in the next 2-3 years, over Rs.50,000 crore will be spent by SME companies in acquiring IT infrastructure. The SME sector is realizing the importance of having server-based IT systems, as opposed to disaggregated standalone systems. As discussed earlier, the very presence of an IT server calls for UPS systems. With e-governance picking up, the SME sector is also keen to convert routine activities like tax payment electronically, inspiring the need for formal IT infrastructure.

In summary, the power backup and conditioning equipment industry will be on a growth trajectory, regardless of the progress that India makes in terms of power availability and power quality. Power backup equipment fit snugly into the evolving ecosystem where absence of connectivity – whether electrical or digital – is unthinkable.